What founders can consider with slipping seed stage valuations

Seed Stage Valuations Slipped in 2020:

What founders seeking seed-stage investments should consider and current trends

Author: Mike Freeman, General Partner and CEO at Innosphere Ventures, a business incubator working at the intersection of technology startups, venture capital, and technology-based economic development.

Essential for founders who are raising capital is having a clear understanding of current trends in the venture capital industry. The majority of companies joining Innosphere’s program are seeking their first equity funding round, so we’ve always had a keen focus on seed-stage investment trends.

PitchBook recently reported on overall valuation and venture trends. The following summary is based on PitchBook data on seed-stage funding, followed by some of my own thoughts on what entrepreneurs need to consider based on the implications of these trends.

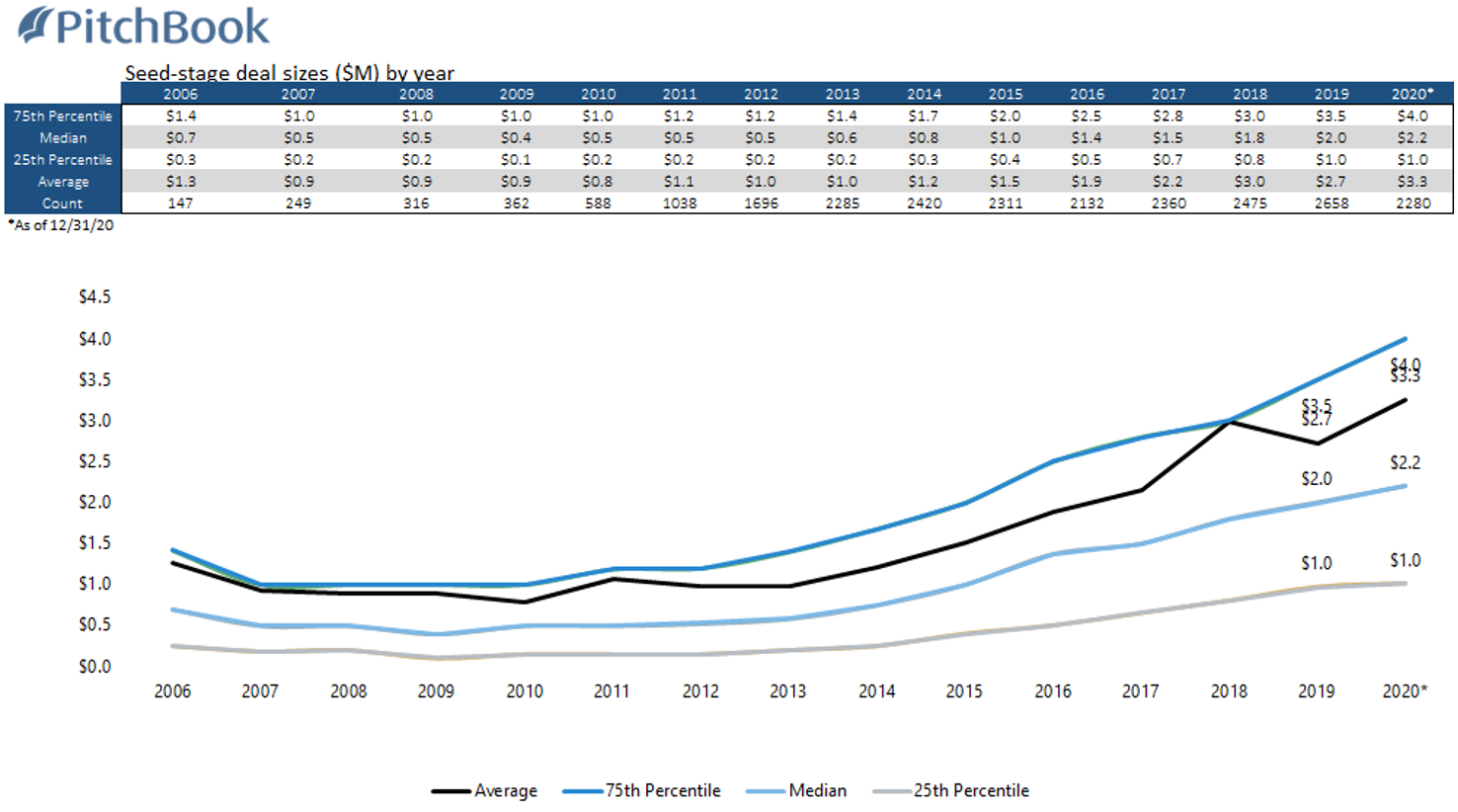

Trend One:

Median and average seed-stage deal sizes increased in 2020, with the steepest increase being the average deal size. The 25th percentile deal size was unchanged from 2019.

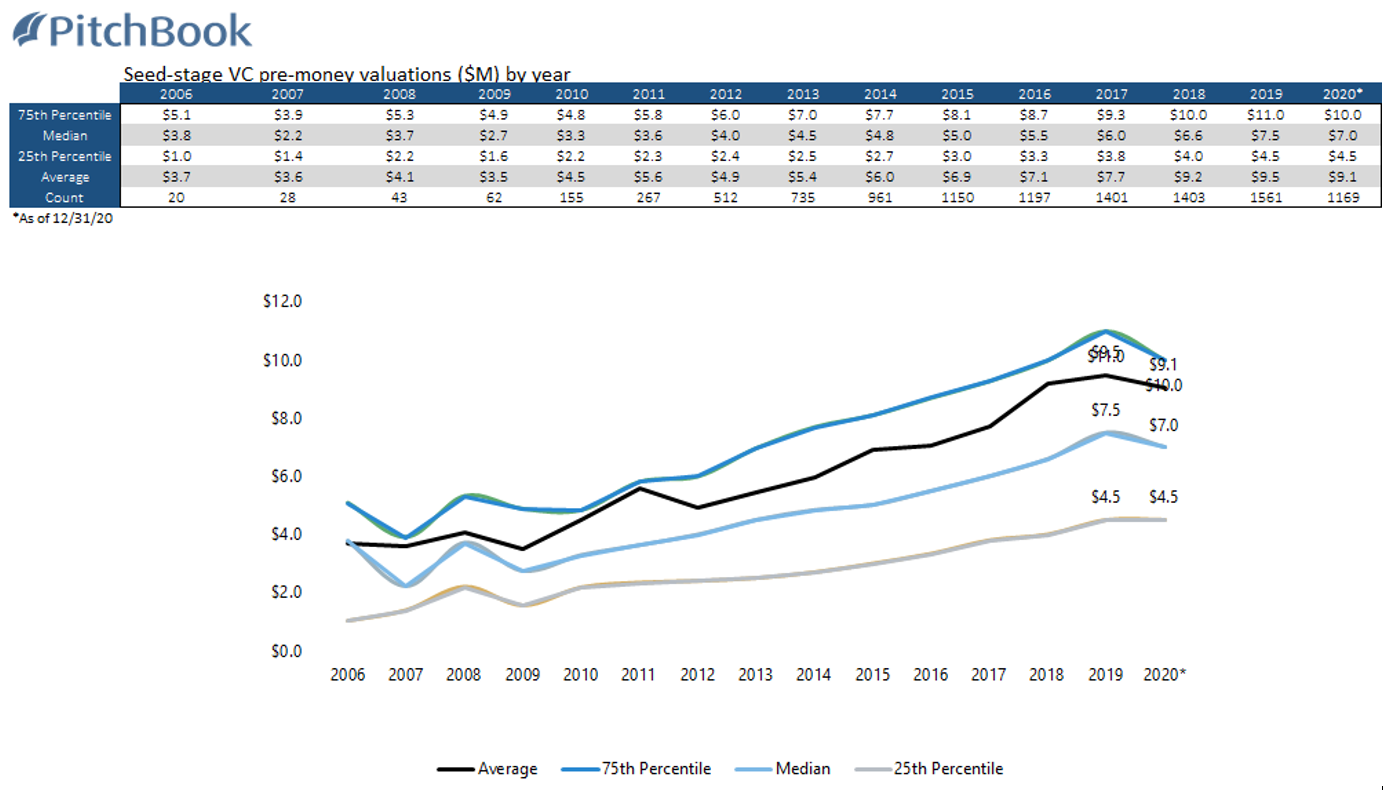

Trend Two:

Median and average seed pre-money valuations both dropped – with the median valuation dropping more from $7.5M in 2019 to $7.0M in 2020, respectively. The 25th percentile pre-money valuation was unchanged from 2019.

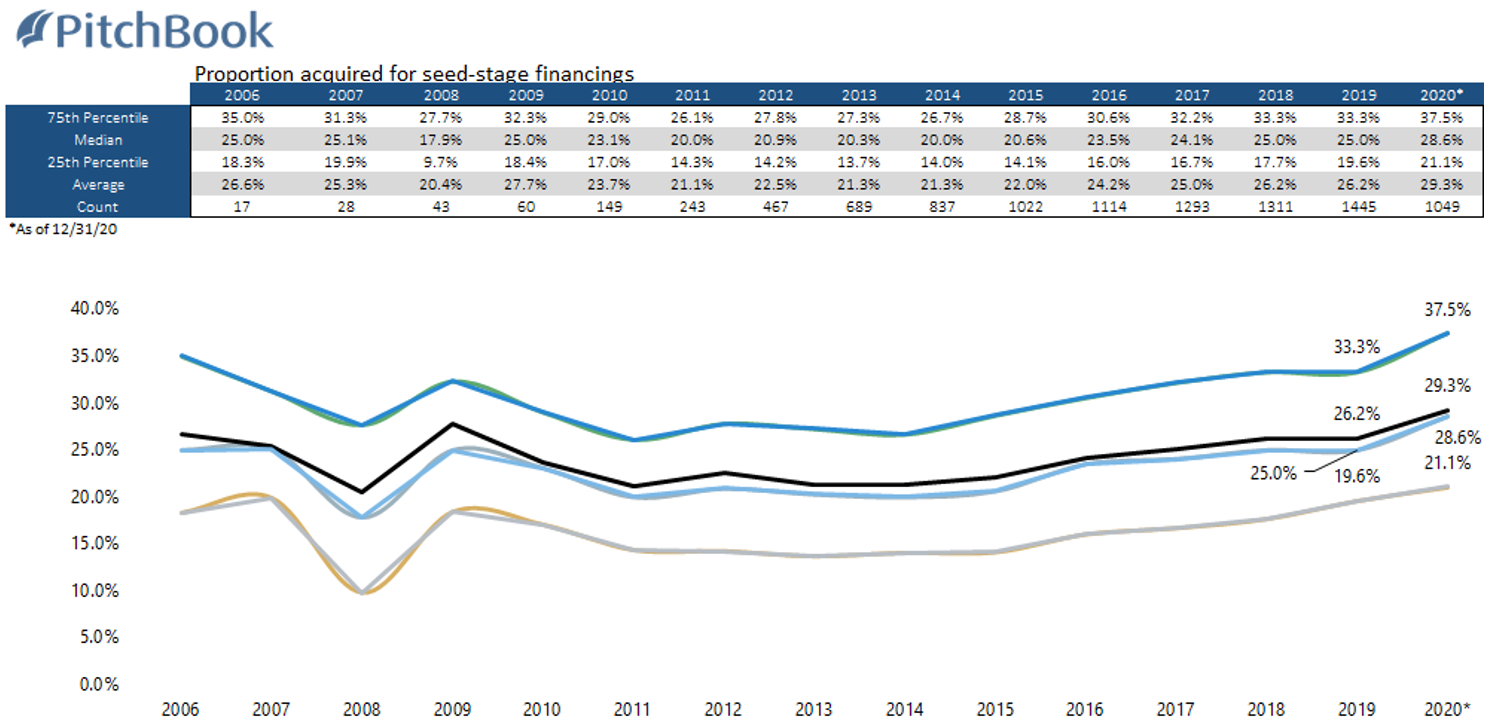

Trend Three:

The proportion of a business acquired during the seed round of funding for the median and average proportion rose from 28.6% to 29.3%, respectively. In Innosphere’s commercialization program, we work closely with founders to understand venture trends, and one of the most surprising elements of raising first capital is the likely amount of the business acquired during the seed-stage round of funding.

If you are a founder seeking seed-stage investment, here are my thoughts and recommendations to consider:

- While valuations are slipping for seed-stage investments, what we see increasing are the median and average amounts of investment capital, as well as the proportion of the company acquired in the seed round. You should be prepared to sell about 30% of your business in the seed round or consider bootstrapping longer to gain a higher valuation based on your traction and revenue. Having a capital plan in this environment is crucial for managing dilution throughout subsequent rounds of funding. Get help if you don’t have a firm grasp of venture financing.

- The median timeline between founding a technology startup company to a first financing increased to two and a half years in 2020 (incredibly, this average was only one year a decade ago), supporting the notion of waiting longer to raise the first funding. However, to accomplish this plan, founders need to pursue deliberate capital-light strategies in the early years to survive the longer time to their first fundraise. Building a capital-light business is not easy, but founders are finding ways to do this.

- Get help by joining an accelerator or incubator program, such as Innosphere Ventures. You will learn from experts on how to handle these complex items. Innosphere supports science and technology startup companies in the Mountain and Plains region of the U.S. If you’re ready to accelerate your company’s growth, you’re encouraged to download the application and apply to the program!

— Blog author: Mike Freeman, General Partner and CEO of Innosphere Ventures